Encumbered Security? Vertical and Horizontal Repos in the Euro Area and Their Inherent Ambiguity

This post is a bit different from my usual ones. Instead of discussing a market development or a macroeconomic indicator, I’ll be delving into one of the academic papers I co-authored, which was recently published in the Journal of Financial Regulation. The paper analyzes repo markets in the Eurozone and how these seemingly technical mechanisms played a crucial, yet often overlooked, role in the European sovereign debt crisis. More specifically, we discuss how vertical and horizontal repos work, the inherent ambiguity of collateral in this context, and how Europe’s monetary architecture paradoxically relies on this ambiguity to function. Today’s post provides a clear and accessible overview of these ideas, focusing on their systemic implications and what they reveal about the nature of modern finance in Europe.

Despite their central role in market-based finance, repurchase agreements - or repos -have remained conceptually ambiguous and empirically understudied within European monetary governance. In our recent article, "Encumbered Security? Vertical and Horizontal Repos in the Euro Area and Their Inherent Ambiguity", co-authored with Steffen Murau and Matteo Giordano and published in the Journal of Financial Regulation, we aim to rethink how repos function within Europe’s monetary architecture. We develop a new analytical framework - based on monetary hierarchy and balance sheet methodology - that distinguishes between different types of repo transactions and highlights how their inherent ambiguity is not an anomaly but a defining feature of the system.

At the heart of our approach is the concept of monetary hierarchy - the idea that different monetary instruments are not equal in terms of acceptability and liquidity. Central bank reserves occupy the top of this hierarchy, followed by commercial bank deposits, and then by various forms of shadow money issued by non-bank institutions. The position of an institution in this hierarchy determines the type of liabilities it can issue that will be accepted as “money” by others. This hierarchy has profound implications for understanding when repo transactions involve money creation and when they simply redistribute existing liquidity.

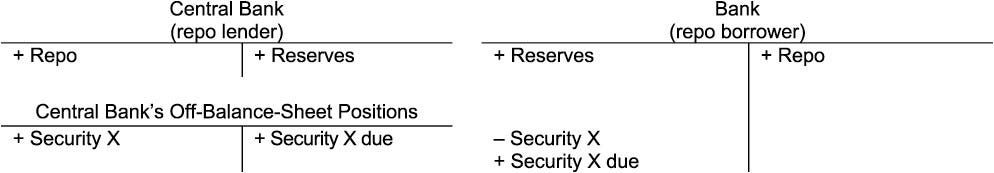

We argue that the current literature treats repos as a monolithic instrument, whereas in practice they differ depending on the hierarchical relationship between the counterparties. We introduce a crucial distinction between vertical and horizontal repos. Vertical repos occur between institutions on different levels of the monetary hierarchy - most notably between commercial banks and central banks. These transactions expand both balance sheets and thus involve the creation of new money (such as central bank reserves).

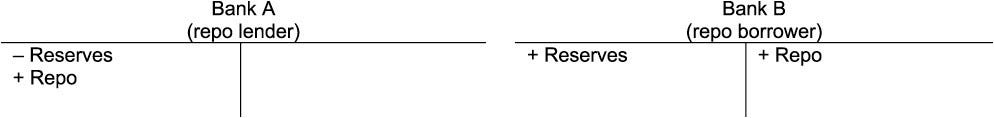

Horizontal repos, by contrast, are carried out between institutions on the same level - such as between two commercial banks or non-bank financial institutions - and involve lending of pre-existing money. These transactions are balance sheet asymmetric: one expands, the other contracts or shifts assets, but no new money is created.

A second major intervention we make is in addressing a longstanding regulatory and analytical blind spot: the whereabouts of the security used as collateral during a repo’s maturity period. While European legal frameworks treat repos as outright sales with full title transfer of the underlying security, accounting practices often retain the security on the borrower's balance sheet as “encumbered”. At the same time, the lender may treat the same security as available for reuse or rehypothecation. This produces what we term a bilocation of the collateral - the same security is treated simultaneously as encumbered by the borrower and as disposable by the lender. This duality introduces a fundamental ambiguity about the legal, regulatory, and balance sheet status of the collateral. It is not merely a technical glitch - it is the very feature that enables financial flexibility within strict legal boundaries, especially in a context like the EU where monetary financing by central banks is formally prohibited under Article 123 of the Treaty on the Functioning of the European Union.

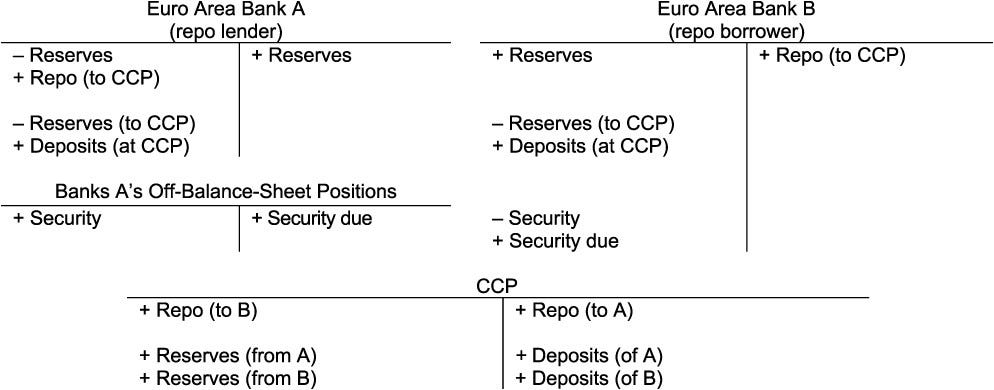

To clarify this ambiguity, we use a quadruple-entry balance sheet methodology that allows us to map out both the cash and collateral legs of a repo transaction in a way that complies with the logic of double-entry bookkeeping. We do this by visualizing both the standard booking of a repo IOU and the separate transfer of the security as a second transaction. The security, we argue, appears as an off-balance-sheet asset of the lender, paired with a liability to return it. For the borrower, it remains on balance sheet but marked as “due”. This allows us to formalize the elasticity created by repo transactions - both in monetary terms and in collateral availability - while also identifying the institutional leeway that ambiguity enables.

We apply this framework to two empirical cases at the core of the Euro Area’s financial infrastructure: vertical repos via the Eurosystem and horizontal repos in interbank markets, especially those mediated through central counterparties (CCPs).

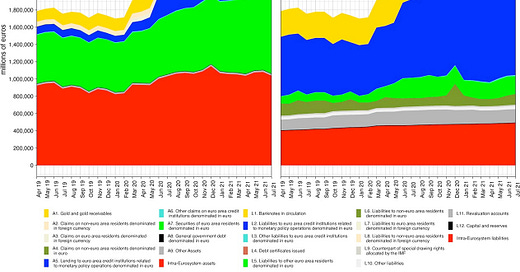

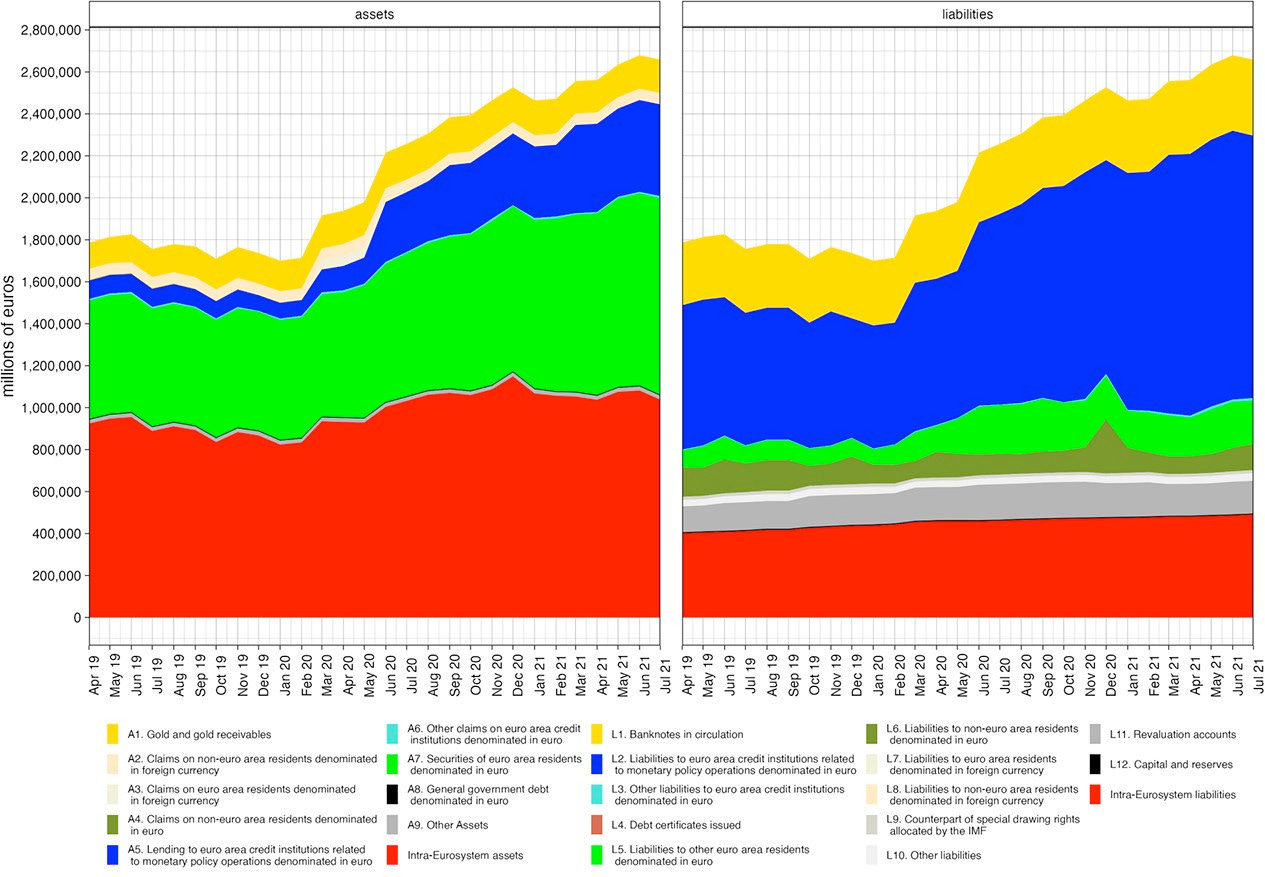

In the vertical case, commercial banks borrow reserves from their national central banks by pledging collateral - typically sovereign bonds. These transactions are the backbone of monetary policy implementation. By adjusting the eligibility criteria and risk parameters of its collateral framework, the Eurosystem can influence which securities are deemed acceptable and on what terms. Our notation system shows how this framework does not just passively reflect market conditions, it actively reshapes them. The Eurosystem effectively governs the elasticity space of the entire financial system through collateral policy, with implications for sovereign bond liquidity and funding stability.

In other words, banks use money-creating vertical repos to borrow from 'their' national central banks (NCBs) in the Eurosystem. They get newly created reserves by pledging collateral which touches the NCBs' 'off-balance-sheet balance sheet'. The collateral is typically a sovereign debt security. The 2nd operation thus helps fund sovereign debt on NCB balance sheets without writing it down explicitly. The funding is off-balance-sheet, just a loan appears on-NCB-balance-sheet (cf Bundesbank example). States fully depend on this off-balance-sheet central bank funding for their structural sovereign debt burden.

In the horizontal case, banks lend to each other in secured repo markets, often via CCPs like Eurex. These transactions do not involve money creation but redistribute reserves within the banking system. Nevertheless, the underlying mechanics mirror those of vertical repos. CCPs have increasingly adopted structures that mimic the Eurosystem’s collateral framework, meaning that private repo markets now operate under similar eligibility regimes. This replication amplifies the effects of central bank policy and embeds public criteria into private market functioning.

Here, the distinction between General Collateral (GC) and Special Collateral (SC) repos becomes especially relevant. In a GC repo, the collateral is not of primary interest - what matters is accessing cash liquidity. The borrower is willing to post any security from a predefined “general collateral basket” and typically accepts a lower interest rate. These transactions are often cleared via CCPs and are foundational to money market functioning and collateral reuse. Importantly, the composition of GC baskets is shaped by both market convention and regulatory guidelines, including central bank collateral frameworks. Hence, GC repos reflect the system’s general liquidity condition and are sensitive to shifts in collateral eligibility.

By contrast, SC repos are conducted when the lender specifically wants a particular security - often due to scarcity, delivery obligations, or short-selling strategies. In these cases, the collateral itself is the objective, and the lender is typically willing to offer cash at a lower rate (or pay a premium) to obtain the specific bond. SC repos are crucial in the pricing and distribution of sovereign debt, as they reveal which securities are “on special” due to market stress or strategic demand. During the Eurozone crisis, this distinction became acute: some periphery sovereign bonds shifted from being accepted as GC to being treated as SC - or excluded altogether - which had major consequences for their market liquidity.

The transition of a bond from GC to SC - or its exclusion from collateral baskets entirely - is one of the key moments of fragility in European repo markets. Once a bond ceases to be eligible in either the Eurosystem’s operations or private GC baskets, it is effectively shut out of liquidity channels. This not only undermines the repo-based funding of banks holding these bonds but also triggers a cascading decline in the bonds’ price and acceptability. Our framework allows us to depict how such shifts shrink the elasticity space across both central bank and interbank balance sheets.

Our empirical analysis revisits the Eurozone sovereign debt crisis through the lens of this framework. We argue that both vertical and horizontal repo markets played a central role in the crisis dynamics - particularly when specific sovereign bonds were downgraded or removed from general collateral baskets. The ineligibility of certain securities meant they could no longer access repo-based liquidity, leading to funding disruptions, fire sales, and yield spikes. These effects were amplified by the bilocation of collateral: when the same security was simultaneously encumbered and re-used, the withdrawal of eligibility created a systemic contraction in both funding and liquidity. What emerged was a self-fulfilling crisis dynamic fueled by changes in collateral status and the ambiguous legal structure underpinning repos.

In sum, we argue that the inherent ambiguity of repos is not a flaw to be corrected but a structural feature of how modern financial systems function - particularly in the Euro Area. This ambiguity facilitates regulatory flexibility, enables off-balance-sheet operations, and supports liquidity under constrained legal frameworks. However, it also introduces fragility, as the very same ambiguity can become a source of opacity and systemic risk during periods of stress.

Our contributions speak to several overlapping literatures. For scholars working within the Money View, critical macro-finance, or law and political economy, we offer new tools to conceptualize repo transactions not just as instruments but as mechanisms embedded in hierarchical monetary systems. For policymakers and regulators, our analysis highlights the importance of recognizing and governing the elasticity space repos provide. Ignoring the ambiguity of collateral status may offer short-term flexibility, but it builds longer-term opacity into the financial system - opacity that can quickly become dangerous in times of crisis.

This paper could be read open-access here.