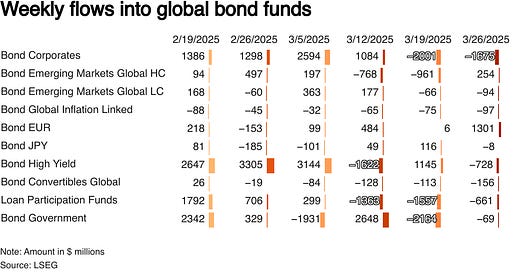

In the week ending April 9 (but even after that), global financial markets absorbed a seismic jolt. The twin shocks of a sharp escalation in the US-China trade war and mounting recession fears sparked a worldwide flight from risk, and, more unusually, even from traditionally safe assets. Global bond funds saw $25.71 billion in outflows, the most in over five years, as fear crept into corners of the market once considered unshakeable.

The United States, unsurprisingly, found itself in the eye of the storm. Trump Administration's dramatic decision to raise tariffs on Chinese imports to a steep 145% ignited a retaliatory response from Beijing, which raised duties on US goods to 125% by the end of the week. US Treasuries, the bedrock of global finance, experienced a so-called violent selloff, pushing the 10-year yield up by 45.5 basis points to 4.45%.

At first glance, this looked like the beginning of a major unraveling. US bond funds recorded net outflows of $15.64 billion, with high-yield and loan participation funds suffering especially deep cuts.

Source: LSEG Lipper; Reuters

Yet, the panic was far from indiscriminate. Short-to-intermediate government and Treasury funds, in fact, posted $8.89 billion in net inflows, signaling that many investors were not abandoning Treasuries, but reallocating within them, favoring lower-duration as volatility surged (in a logical way, I would say!). Furthermore, in the figure below we are observing a slight inflow into inflation protected funds. This inflow indicates one thing: the markets are expecting a temporary inflation spike driven by tariffs. Another argument in this direction (i.e. that the inflation spike will not be “permanent”) is the fact that the 10-year breakeven inflation rate is below the 5-year breakeven inflation rate (2.19% vs 2.32%). This is known as an inversion in TIPS curve (meaning markets expect inflation to be higher in the near term rather than longer-term). As such, markets do not foresee persistent inflation, especially after the recent release of the March Producer Price Index (PPI) today, which showed a surprising decline of 0.4% month-over-month.

As such, there is no indication of reduced demand for US Treasuries (or a loss of their safe-haven status), but rather a recalibration.

Source: LSEG Lipper; Reuters

Continuing on this line, equally important, what unfolded was not a systemic breakdown, but a brief period of dislocation, primarily driven by leveraged hedge fund trades. These included so-called relative value strategies, like the swap spread trade, where hedge funds exploit pricing mismatches between Treasuries and derivatives using heavy leverage. As yields spiked during the Asian and European sessions, bid-ask spreads widened, in some cases doubling from normal levels, and some banks grew cautious, pulling back financing and triggering margin calls.

Still, this was not a crisis - it was more of a stress test. And the market passed.

By Wednesday morning in New York, liquidity improved. Dealers stepped in with capacity. Trading desks saw signs of normalization. Most tellingly, the 10-year US Treasury auction that day was met with robust demand, particularly from foreign investors. Moreover, there are two encouraging factors. First, dealer participation was below average last month, accounting for just over 10%. This suggests that demand came from a more diverse set of investors - had demand been weak, dealers would have had to step in with a larger share to cover the shortfall. Second, the bid-to-cover ratio stood at 2.67, the highest since December.

Source: MacroMicro

That successful auction was a key litmus test, offering reassurance that, even in turbulent conditions, global demand for U.S. government paper remains resilient. Right after that, the same robust demand was seen in a 30-year auction.

Moreover, US equities offered another counterpoint to the prevailing gloom. After weeks of outflows, US equity funds attracted $6.44 billion, a reversal that TD Securities attributed to dip-buying behavior among low-cost index fund investors. Globally, equities were not so fortunate: $10.7 billion exited global equity funds, and sectoral redemptions were widespread, with financials, healthcare, and tech bearing the brunt.

Meanwhile, gold and precious metals - traditional hedges against both inflation and geopolitical volatility - booked their ninth consecutive week of inflows, drawing $1.03 billion. Even here, however, the US managed to absorb the storm better than most. Emerging markets suffered yet another blow, with $4.9 billion and $3.6 billion in outflows from equity and bond funds, respectively.

Source: LSEG Lipper; Reuters

Ultimately, the narrative of April’s market turmoil is not one of lost faith in US Treasury, not yet at least. Investors did not flee Treasuries wholesale, they simply shifted their positioning. Some leveraged strategies were unwound, but the system proved resilient. The strong demand at the 10-year auction (but even at 30-year) served as a reaffirmation that the US Treasury market, despite the short-term volatility, remains the global benchmark for safety and liquidity.

Markets may be anxious, but confidence in the structural strength of US markets - especially Treasuries - endures. For now.