The global economy is experiencing a bloodbath - commodities, stocks, nothing has been spared by the “tariff news”. But I won’t bore you with what you’ve probably read everywhere. Instead, I want to focus on some key data points next to this turmoil: labor market data, specifically those reported by the Department of Labor and Challenger, Gray & Christmas.

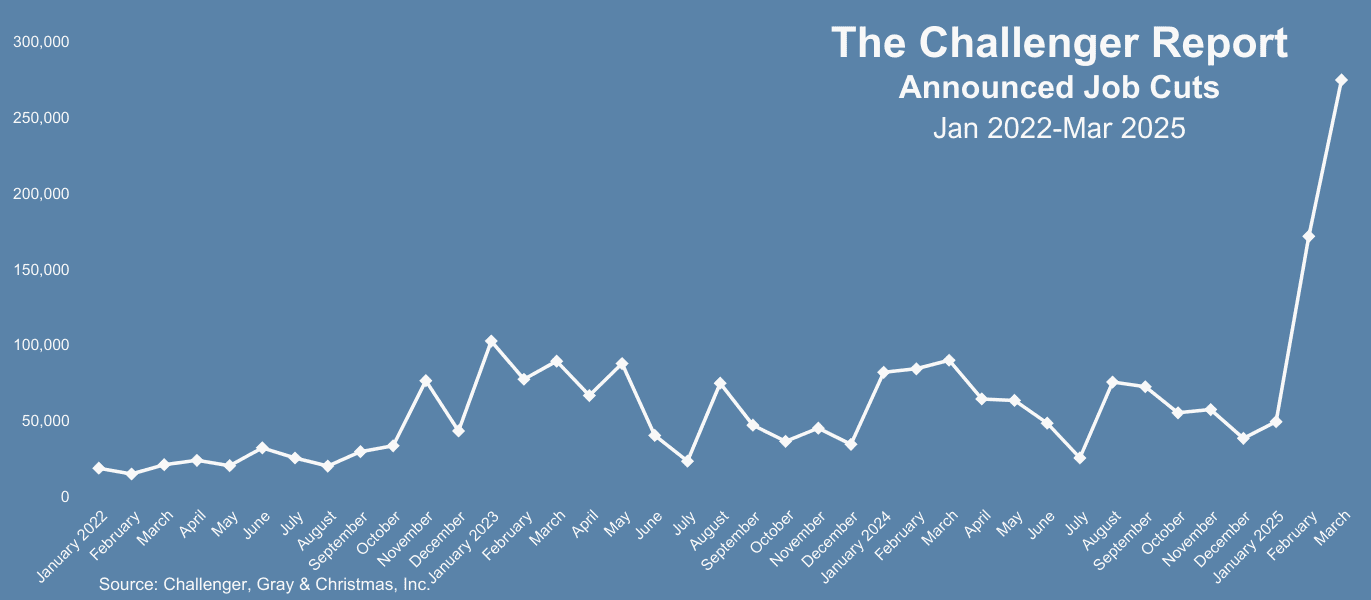

The latest labor market data shows a grim picture of employment conditions in the US economy. On one hand, layoffs surged in March, reaching 275,240 - the highest level since May 2020 - driven primarily by large-scale federal government job cuts. But the problem isn’t limited to the public sector; the private sector is also struggling. All of this has contributed to a total of 497,052 layoffs in the first quarter of the year, a figure not seen since the depths of the Great Recession in early 2009.

In more detail, the driving force behind the increase in layoffs is primarily federal government downsizing, with more than half of the job cuts originating in Washington, D.C. These layoffs have affected employees and contractors across 27 federal agencies, signaling a significant shift in government employment policies. Unlike private sector layoffs, which often reflect broader economic downturns, these reductions are largely a result of budgetary constraints and fiscal policy decisions. However, the spillover effects are already being felt in nonprofit and healthcare sectors, which are heavily dependent on government contracts and funding.

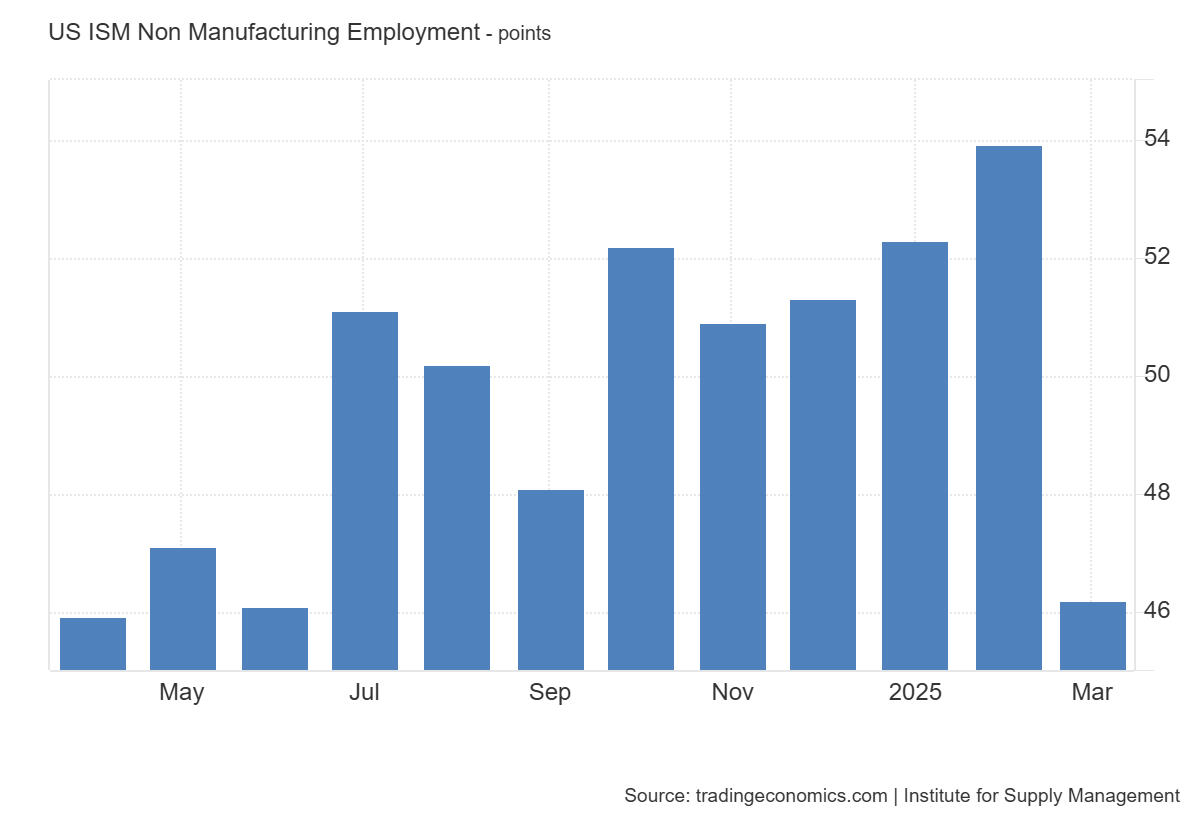

Beyond government job cuts, layoffs have also risen in key sectors such as technology and retail. For instance, technology companies announced 15,055 job cuts in March, a 3% increase from the 14,554 cuts announced in this sector one month prior. These industries have already faced significant job reductions over the past year, and their continued struggles suggest a deeper trend of economic softening. Retail, in particular, is highly sensitive to consumer demand, and job cuts in this sector may indicate weakening consumer spending. However, these job cuts are likely to continue if we look at today’s US non-manufacturing PMI survey. For the first time in the past six months, the employment subindex has fallen below 50 - entering contraction territory - dropping to 46.2, a sharp decline of 7.7 points in just one month.

The manufacturing survey isn’t faring any better. For instance, the Employment Index registered 44.7 percent, down 2.9 percentage points from February (47.6).

Despite the surge in layoffs, initial jobless claims declined to 219,000 in March, defying expectations. This suggests that many recently laid-off workers have not yet filed for unemployment benefits, likely due to severance packages that temporarily cushion the impact of job loss.

Additionally, continuing jobless claims only saw a slight increase to 1.903 million, indicating that those already unemployed are not facing dramatically worsening conditions. However - and this is an important point - this stability is temporary, as severance packages eventually expire and displaced workers begin to seek new employment opportunities. Which means that reality is much harsher than these figures suggest (even though these figures are far from "friendly" themselves).

Another troubling sign is the sharp decline in hiring plans. Employers announced just 13,198 new hires in March, a steep drop from 34,580 in February, marking the weakest first-quarter hiring since 2012 (!). This suggests that even as layoffs rise, businesses remain hesitant to expand their workforce, possibly due to economic uncertainty and tightening financial conditions. This means that we cannot expect the employment rate to grow organically in the immediate future, perhaps with the exception of seasonal fluctuations. However, we cannot anticipate any fundamental (positive) changes in the labor market.

In summary, while the labor market has absorbed a substantial wave of layoffs without an immediate spike in unemployment claims, underlying risks remain. The persistence of weak hiring trends and the potential for delayed impacts from government job cuts could challenge the current perception of labor market stability. If these factors continue to weigh on employment, the resilience observed thus far may prove to be short-lived.

very concise and informative Alex, and I think the graphics are definitely more descriptive. great work here