April 2025 brought a fresh wave of disillusionment across the EU and euro area, as we can see in the European Sentiment report just published today.

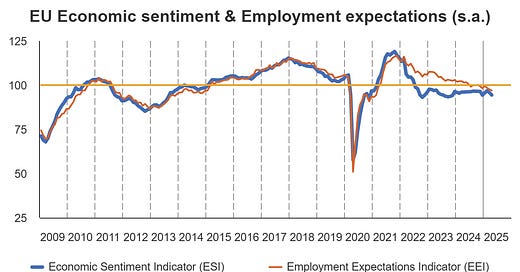

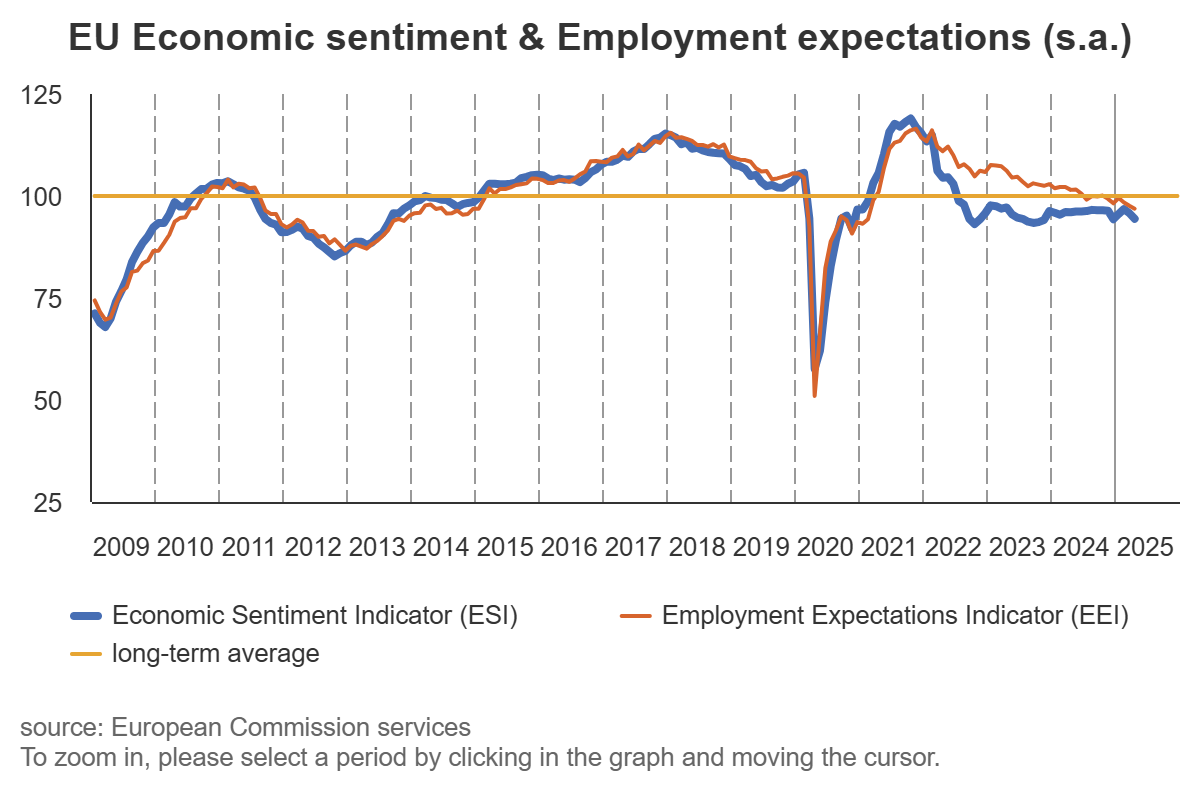

The Economic Sentiment Indicator (ESI) declined by -1.4 points in both regions, falling to 94.4 in the EU and 93.6 in the euro area - both below their respective long-term averages. In the euro area, the indicator fell from a revised 95.0 in March to below market expectations of 94.5. While these are not dramatic declines, they don’t appear to be isolated blips either - rather, they reflect a gradual erosion of economic morale, especially when we dive deeper into the data. For instance, the last time the ESI in the EU stood at 94.4 was in December 2024; before that, it was only in November 2023. The picture is even gloomier when it comes to employment expectations. The last time the Employment Expectations Indicator dropped below 97 was back in February 2021 (!), still in the midst of the pandemic crisis.

Source: European Commission

That’s not all. For instance, consumer confidence fell steeply (-2.1 points), with all four subcomponents deteriorating: views on household finances (past and future), major purchases, and the general economic outlook. The latter saw a particularly pronounced decline, reflecting rising anxiety about macroeconomic stability.

Retail trade confidence also tumbled (-1.7), driven by sharply lower assessments of both past and expected business performance. Though stock assessments ticked up slightly, it wasn’t enough to offset broader pessimism. Services sector confidence fell by -1.0, as managers downgraded all three indicators - past demand, expected demand, and their recent business situation. So, we’re seeing negative expectations both from households and from business performance - the “perfect” mix, so to speak.

Industry confidence was flat overall (-0.3), masking conflicting signals. Production expectations weakened sharply, but this was offset by improved assessments of finished product stocks and current order books. Notably, export order books worsened slightly, while views on past production improved markedly, a rare bright spot that still doesn’t inspire much optimism (it looks like it’s the only bright spot from this report).

The Employment Expectations Indicator (EEI) declined again in the EU (-0.7 to 96.9), while staying unchanged in the euro area (96.5). The drop was fueled by weaker hiring plans in retail, services, and construction. Industry was the only sector with improved hiring sentiment. However, consumers’ unemployment expectations, which are not part of the headline EEI, worsened - adding psychological pressure in an already fragile environment.

The EU Labor Hoarding Indicator inched up to 10.7% (+0.2), continuing an upward trend since late 2024 and exceeding its long-term average of 9.7%. This suggests that firms are holding onto labor despite soft demand, perhaps out of fear they won’t be able to rehire later - a sign of growing caution. I’m pointing this out precisely because the EEI declined further (-0.7), which signals a reduced willingness to hire.

Meanwhile, inflation dynamics remain uneasy. Selling price expectations declined slightly in industry and were broadly flat elsewhere, but still above long-term averages. Consumers’ price expectations for the next 12 months surged again, while their retrospective inflation perceptions eased slightly. This combination - forward-looking inflation fear amid fading past inflation - is a confusing signal for policymakers and markets alike.

The Economic Uncertainty Indicator (EUI) jumped by +2.8 points to 20.4 in April, the highest since early 2023. Industrial managers reported the sharpest increase in uncertainty, reaching a 27-month high (!). Services and retail uncertainty also increased, while construction remained stable. Consumer uncertainty about their financial situation surged to the highest level since February 2024.

Last but not least, another weakness is the capacity utilization in Euro Area industry. It rose marginally (+0.4 pp to 77.3%), but remains well below its 80.39% average. This points to insufficient demand, but it’s also tied to rising uncertainty - which, in turn, is weighing on production, keeping it below seasonal norms.

The message is clear: the EU economy is stuck in a demand-driven slowdown, clouded by persistent uncertainty and inflation concerns. Absent a coordinated policy jolt, April’s data suggest that Europe may be slipping deeper into stagnation - quietly, but steadily.